Microsoft’s 2013 fourth quarter and end of fiscal year results are not fun. On the surface of things, it is all about the Surface debacle. Not quite an MS Bob level tragedy, but everyone is ticked off about the whole thing: Microsoft, its partners, its investors, post-PC era, yadda, yadda, yadda.

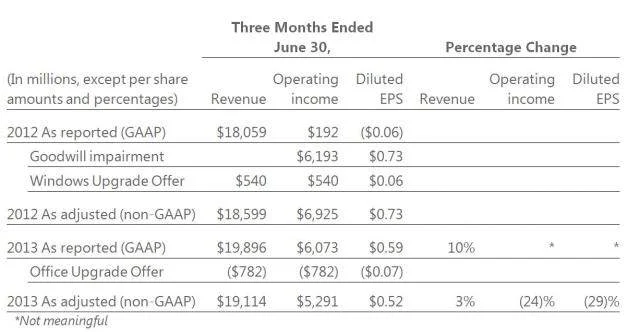

Microsoft’s fiscal year ends June 30. Yeah, that’s really weird for the normals among us and very un-Christmasy. So, the company announced quarterly revenue of $19.90 billion for the quarter ended June 30, 2013. For Microsoft’s fiscal year 2013 (even though it is the middle of the real 2013, it is the end of Microsoft’s fiscal 2013n – geddit?), the company’s revenue, and operating income were $77.85 billion and $26.76 billion.

The thing that kicked Microsoft in the guts and has the Internets buzzing with pontificating financial wizardry is a $900 million charge related to Surface RT inventory adjustments. That means, Microsoft done gone and screwed itself on that launch.

In general, the different divisions of Microsoft, which will no longer be reported like this now that they have been reorganized, look like this:

Microsoft Business Division revenue grew 14% for the fourth quarter and 3% for the full year.

Server & Tools revenue grew 9% for the fourth quarter and 9% for the full year, driven by double-digit percentage revenue growth in SQL Server and System Center.

Windows Division revenue grew 6% for the fourth quarter and 5% for the full year. Excluding the impact of the prior year Windows Upgrade Offer revenue deferral, Windows Division non-GAAP revenue decreased 6% for the fourth quarter and 1% for the full year. In June, Microsoft released the public preview of Windows 8.1 which will be made available to OEMs in August. Meaning, Windows is sucking a little wind in the post-PC era (we never tire of saying that phrase).

Online Services Division revenue grew 9% for the fourth quarter and 12% for the full year, driven by an increase in revenue per search and volume. Bing organic U.S. search market share was 17.9% for the month of June 2013, up 230 basis points from the prior year period.

Entertainment and Devices Division grew 8% for the fourth quarter and 6% for the full year. During the quarter, transactional revenue within Xbox LIVE grew nearly 20%, and Microsoft unveiled the Xbox One. It got booed, but let’s not go there.

Quite rightly, over at CRN, they are a bit upset with Microsoft because they reckon Surface tablets should have been sold through the channel to the enterprise, OEMs be damned. CRN getting mad is a big deal because, they don’t usually get mad about anything.

Since it was first unveiled last summer, the company’s go-to-market strategy for Surface tablets has been a thorn in the side of the channel and a blight on Microsoft’s channel reputation. It started with Microsoft’s baffling decision to sell Surface and Surface Pro devices through retail only, first through Microsoft Stores and then through select retail partners like Best Buy, Staples and Frye’s.

Over the last two weeks, the situation worsened; Microsoft made a mockery of its channel strategy with its new plan to bring Surface to the channel via the Microsoft Devices Program. A mess of contradictory decisions and statements has provided a mountain of evidence that Microsoft has lost its grasp not only on the basics of channel economics but also the value of the solution provider partner.

Oh, my! Ballmer hasn’t made things any calmer with his re-org, either. TechWeek Europe had this to say about the epic email:

So what did Ballmer promise? In a very long and somewhat rambling memo, he laid out the new functional organisation that Microsoft will follow. He also said that the changes were strategic and that current projects, such as Windows 8.1, Windows Phone and the Xbox, would be unaffected for now. Ballmer also talked about reforming the Windows Store and moving to a business model that could keep up with changes in technology.

But what Ballmer didn’t really address is something much more important in the long run, and that’s finding out what customers actually want in terms of products from Microsoft and how they want those products delivered. It’s here that big technology companies are finding that opportunities are rife for missteps. How else can you explain the debacle that was Windows 8?

Microsoft was well aware that customers like Windows and Windows-like operating systems. Other people know this: many of the user interfaces for Linux look like they came straight from Redmond, for example.

Windows 8 probably tested very well with people using mobile devices where it makes sense.

But how could Microsoft’s product managers release a touch-based operating system interface on a customer base that is equipped in large part with a keyboard and mouse hardware? Clearly Microsoft was trying to drive innovation by encouraging a touch interface.

Few people in the real world are going to drop a thousand or so dollars just so they can use a new OS.

That’s especially true in the business world where hardware replacement budgets have suffered greatly at the hands of the worst economic downturn since the Great Depression.

Of course, people don’t just resist having change forced on them by Microsoft. As Apple is finding out from the shrinking market share of the iPhone, they don’t appreciate being told what they want by Apple either.

Okay, time to have some chocolate. We ain’t quittin’ on you, Microsoft, but we sure ain’t going to shack up with you anymore, either.

So, first Intel then Microsoft. Dell looks pretty shaky right now, too. I feel a giant hole is opening up in the middle of the planet and we are all going to get sucked into it while we Tweet our fate and knock out a few Vines.